Financial Statement Preparation.

What are Financial Statements?

Financial statements are the report cards of your business. They provide a snapshot of your financial health and performance, offering valuable insights to you, investors, lenders, and other stakeholders.

These statements paint a clear picture of:

- What your business owns and owes (Balance Sheet)

- How much money your business is earning and spending (Income Statement)

- How cash is flowing in and out of your business (Cash Flow Statement)

By analysing these statements, you can gain a deeper understanding of your business’s profitability, liquidity, and solvency. This information is crucial for making informed decisions about everything from day-to-day operations to long-term growth strategies.

Accurate and timely financial statements are essential for:

- Meeting compliance requirements: Australian businesses are required to lodge financial statements with the Australian Securities and Investments Commission (ASIC) and the Australian Taxation Office (ATO).

- Securing funding: Lenders and investors rely on financial statements to assess the risk and potential return of investing in your business.

- Making informed business decisions: Financial statements provide valuable insights into your business’s performance, allowing you to identify areas of strength and weakness, track progress, and make data-driven decisions.

Preparing financial statements can be a complex and time-consuming process, especially for busy business owners. At ProYou Business Advisory, we take the burden off your shoulders by providing accurate, efficient financial statement preparation services as part of our suite of Audit services.

Stay tuned to learn more about the different types of financial statements and how ProYou can help you unlock their full potential for your business success!

What are Financial Reporting Frameworks?

Financial reporting frameworks comprise guidelines dictating the measurement, recognition, presentation, and disclosure of crucial elements within financial statements. They serve as the fundamental basis for constructing financial statements and annual reports.

Types of Financial Reporting Frameworks

Three primary categories of financial statement reporting frameworks are essential for every business to comprehend:

1. General Purpose Financial Statements (Full IFRS)

Tier 1 financial statements are mandated for publicly accountable entities or other entities specifically regulated to prepare General Purpose Financial Statements (GPFS). This framework, which complies with International Financial Reporting Standards (IFRS), is the most comprehensive and detailed, aiming to provide a comprehensive overview of a company’s financial position (commonly referred to as the Balance Sheet), Profit or loss (also known as the Income Statement), and cash flows.

2. General Purpose Financial Statements – Simplified Disclosures

Tier 2 is Simplified Disclosures which requires all recognition and measurement from the Australian Accounting Standards Board (AASB’s), however presentation and disclosure requirements are less detailed than the full General Purpose Framework.

3. Special Purpose Reporting Framework

Special purpose reports offer increased flexibility to most SMEs, as they can adopt any format required by the business. Typically, these reports consist of a simple Balance Sheet and Income Statement following reporting requirements established by the directors, owners, or members of the business.

The degree to which special purpose financial statements must adhere to Australian Accounting Standards varies and depends on specific requirements for their preparation. For instance, special purpose financial statements prepared under Part 2M.3 of the Corporations Act 2001 or under the Australian Charities and Not-for-profits Commission Act 2012 must, at a minimum, comply with the requirements outlined in AASB 101 Presentation of Financial Statements, AASB 107 Statement of Cash Flows, AASB 108 Accounting Policies, Changes in Accounting Estimates and Errors, AASB 1048 Interpretation of Standards, and AASB 1054 Australian Additional Disclosures.

Why is the financial reporting framework important?

Financial reporting frameworks provide both current and prospective investors, lenders, and other stakeholders with structured insights into a company’s financial position, aiding them in making informed decisions regarding funding provision, loan approvals, or management decision endorsements/rejections. Additionally, these frameworks assist businesses in producing concise, well-organized, and easily understandable financial reports.

Key Characteristics of an Effective Financial Framework

- Transparency: The transparency of a financial framework ensures that financial statements accurately reflect underlying economic events. This entails fair representation and complete disclosure.

- Comprehensiveness: A comprehensive framework can be universally applied and includes detailed instructions for recording all types of financial transactions.

- Consistency: Consistency within financial frameworks ensures uniform treatment in the measurement and reporting of similar financial transactions, regardless of industry, location, or time period. While accommodating flexibility, this fosters easier comparison of financial transactions and statements in a meaningful manner.

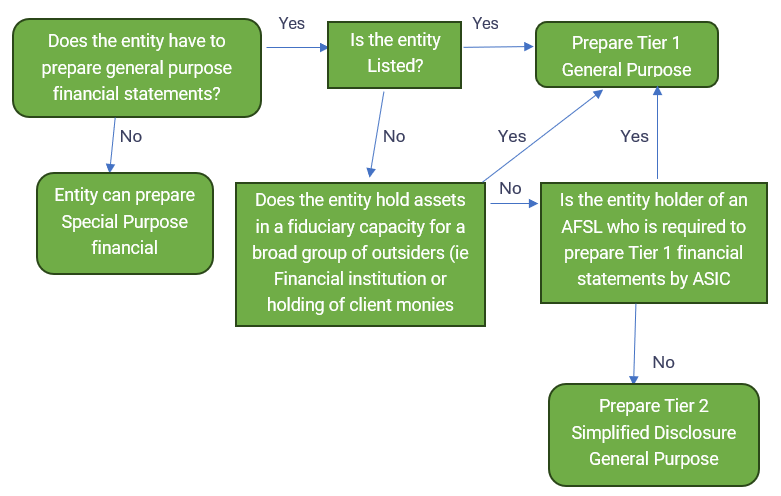

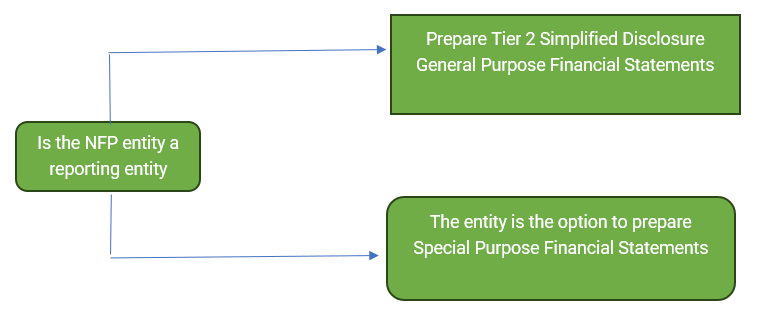

Which framework do I need to prepare?

For-Profit Private Sector Entities

For-Profit Private Sector Entities

Steps Involved in Preparing Financial Statements

Preparing accurate financial statements requires a systematic approach and attention to detail. Here are the key steps involved:

- Gather your financial records: This includes bank statements, invoices, receipts, payroll records, and any other documentation related to your business’s financial transactions.

- Record your transactions: Organise and record your financial transactions in a general ledger or accounting software like Xero. This ensures all your financial data is accurately captured and categorised.

- Reconcile your accounts: Regularly reconcile your bank statements and other financial accounts to ensure their accuracy and identify any discrepancies.

- Prepare adjusting entries: Make necessary adjustments to your accounts to ensure they reflect the true financial position of your business. This may involve accounting for depreciation, accruals, and prepayments.

- Choose an accounting Framework: You can choose between three different frameworks.

- Generate your financial statements: Once your accounts are reconciled and adjusted, you can generate your financial statements under the appropriate framework which will include, Statement of financial position (commonly referred to as the Balance Sheet), Statement of profit or loss (also known as the Income Statement), and cash flows.

- Analyse and interpret your statements: Review your financial statements to gain insights into your business’s performance and identify areas for improvement.

While these steps may seem straightforward, preparing accurate financial statements requires expertise and attention to detail. ProYou Business Advisory can handle the entire process for you, ensuring your financial statements are accurate, compliant, and provide valuable insights to guide your business decisions.

We leverage industry-leading accounting software like Xero to streamline the process and ensure efficiency and accuracy.

Contact ProYou today to discuss your financial statement preparation needs and let us help you gain a clear picture of your business’s financial health.

Common Challenges and Mistakes in Financial Statement Preparation

Even with the best intentions, mistakes can happen during financial statement preparation. Here are some common challenges and mistakes businesses face:

- Incomplete or inaccurate records: Failing to maintain complete and accurate financial records throughout the year can make it difficult to prepare accurate financial statements.

- Misclassifying transactions: Incorrectly categorising income and expenses can distort your financial picture and lead to inaccurate reporting.

- Ignoring accounting standards: Failing to comply with relevant accounting standards can lead to errors and inconsistencies in your financial statements.

- Lack of expertise: Preparing financial statements requires accounting knowledge and expertise. Attempting to do it yourself without the necessary skills can lead to costly mistakes.

Here’s what Mark Shaw, Chartered Accountant at ProYou Business Advisory, has to say about avoiding these challenges:

“The key to accurate financial statements is maintaining organised and accurate records throughout the year. Utilising reputable accounting software like Xero can significantly improve accuracy and efficiency. It’s also crucial to have a solid understanding of accounting principles and relevant standards. If you’re unsure, seeking professional assistance from a qualified accountant can save you time, money, and ensure your financial statements are compliant and reliable.”

By following Mark’s advice and utilising the expertise of ProYou Business Advisory, you can avoid these common pitfalls and ensure your financial statements are accurate and insightful.

Don’t let financial statement preparation become a burden. Contact ProYou today and let our team of experts handle it for you!

Benefits of Accurate Financial Statements

Accurate financial statements are much more than just a compliance requirement. They offer a wealth of benefits for your business, including:

1. Informed Decision-Making

Financial statements provide valuable insights into your business’s performance, allowing you to identify trends, track progress, and make data-driven decisions about everything from pricing strategies to expansion plans.

2. Improved Access to Funding

Lenders and investors rely on accurate financial statements to assess the risk and potential return of investing in your business. Strong financial statements can increase your chances of securing loans, attracting investors, and obtaining favourable financing terms.

3. Enhanced Financial Management

By analysing your financial statements, you can identify areas of strength and weakness in your financial management. This allows you to optimise your cash flow, control expenses, and improve your overall financial performance.

4. Increased Business Value

Accurate financial statements demonstrate transparency and financial stability, which can increase the value of your business and make it more attractive to potential buyers or investors.

5. Reduced Risk of Errors and Penalties

Accurate financial statements help ensure compliance with tax regulations and accounting standards, reducing the risk of errors, penalties, and potential legal issues.

Investing in accurate financial statement preparation is an investment in your business’s success. ProYou Business Advisory can help you reap these benefits and gain a clear understanding of your financial health.

Contact us today to discuss how we can help you prepare accurate and insightful financial statements that empower your business growth.